Wednesday 19th March 2025

Par inAfrika Reporter

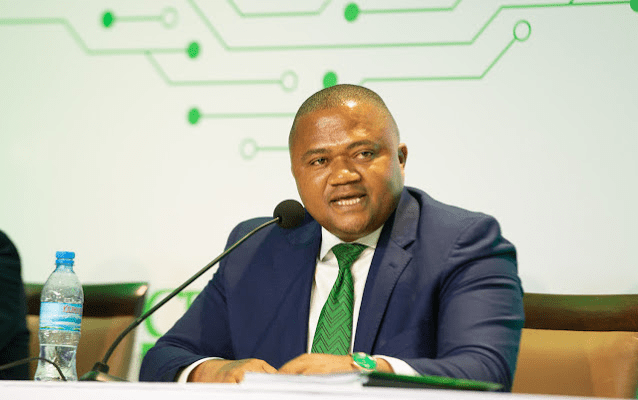

Nairobi – CRDB Bank Group CEO Abdulmajid Nsekela has reaffirmed the bank’s commitment to transforming agricultural financing in Africa, emphasizing the role of digital banking, strategic partnerships, and value chain financing in increasing financial inclusion for smallholder farmers.

Speaking at the High-Level Conference on Scaling Finance for Smallholder Farmers in Africa, held in Nairobi, Nsekela addressed the $90 billion to $180 billion annual financing gap in Africa’s agricultural sector. The event, co-hosted by the Government of Kenya, the African Development Bank (AfDB), and the Pan African Farmers Organization, brought together key stakeholders to explore sustainable financial solutions for smallholder farmers.

“Agriculture is the backbone of Africa’s economy, yet millions of smallholder farmers still struggle to access credit, insurance, and modern farming technologies,” Nsekela stated. “At CRDB Bank, we believe innovation isn’t just about new solutions; it’s about rethinking models, policies, and partnerships to make finance more accessible, affordable, and impactful.”

CRDB Bank has been a pioneer in agricultural financing, having supported over 10,000 farmers across Tanzania and facilitated more than TSh 2.2 trillion in financing. The bank’s approach integrates fintech solutions, digital lending, and agricultural extension services, ensuring farmers receive timely support to enhance productivity and resilience.

The bank’s strategic collaborations with international and regional organizations, including the UN Green Climate Fund (GCF), have played a crucial role in unlocking concessional credit and insurance subsidies that help farmers mitigate climate risks. Guarantee programs have also made financing more affordable, empowering thousands of farmers to expand their operations.

CRDB Bank is also leveraging agri-tech and digital finance to improve access to financial services. Digital tools such as eKYC profiling, satellite mapping, and automated farm management systems are enabling data-driven financial products tailored to farmers’ needs. Partnerships with sustainable agriculture organizations have further improved access to quality inputs, enhancing productivity and resilience.

In 2023, CRDB Bank launched East and Central Africa’s largest Green Bond, the ‘Kijani Bond’, to raise capital for renewable energy, energy efficiency, and climate-smart agriculture. The bond was oversubscribed by more than 300 percent, reflecting strong investor confidence in sustainable financing initiatives.

Agriculture contributes 29 percent of Tanzania’s GDP and employs nearly 65 percent of the population. Nsekela emphasized the critical role of innovative financing in ensuring economic stability and food security.

Scaling digital solutions, strengthening agricultural value chains, and expanding access to climate-resilient financing will position CRDB Bank as a key driver of agricultural transformation in Africa. Smallholder farmers are not only gaining financial inclusion but are also receiving the necessary tools to thrive in an evolving economic landscape.