Thursday 16th October 2025

by inAfrika Newsroom

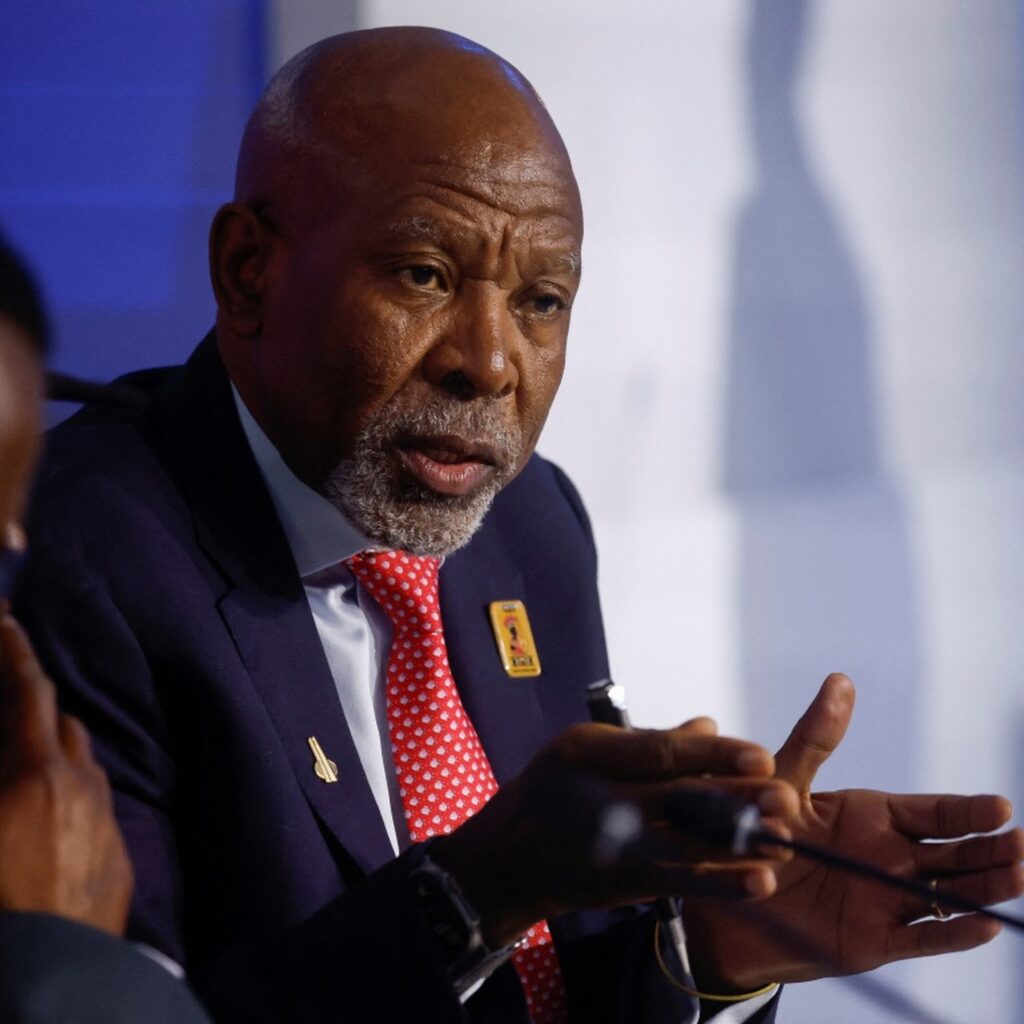

Rising public indebtedness has moved to the forefront of this year’s G20 agenda, the governor of South Africa’s reserve bank said, warning that debt burdens now threaten both emerging and advanced economies. Lesetja Kganyago told finance ministers and central bankers gathering in Washington that global public debt could exceed 100 % of GDP by 2029 under adverse scenarios, citing IMF projections. He stressed that debt sustainability is no longer just a developing-world issue. (Reuters)

Kganyago said the Financial Stability Board will elevate debt pressures as a crisis risk, and he urged stronger coordination among nations. He noted that some African governments are already facing refinancing risks amid high interest rates and tight capital flows.

Among concerns, the South African central bank boss flagged exchange rate volatility, contingent liabilities (especially state-owned enterprises), and rising social spending demands as compounding the debt burden. He called for fiscal consolidation, transparency, and multilateral debt relief mechanisms to remain central.

Investors and analysts view the warning as a signal that financial markets could increasingly penalize countries with weak fiscal frameworks, especially in Africa, Latin America and parts of Asia. Countries with narrow fiscal buffers may struggle to cope with debt rollover pressures as global rates remain elevated.

In Pretoria, some economists welcomed Kganyago’s remarks as sharpening the debate around debt reform and sustainable borrowing. Others urged that Africa’s growth prospects also require flexible policy space to support investment and structural transformation.